© 2020-23 BizApprise. All rights reserved.

20 Best Mutual Funds Apps in India to Invest Money in 2023

Looking for the best app for mutual fund investing? Then, we got you covered. Here’s the complete list of the top 20 best mutual funds apps to start your mutual fund investment journey.

A mutual fund is a type of investment that allows people to pool their money together and then have a professional invest it for them. The fund manager will invest the money in a variety of different assets, such as stocks, bonds, and other securities. Mutual funds are a popular type of investment because they offer several advantages.

First, they provide diversification, which helps to reduce your risk. Another advantage is you don’t need to be an expert in the stock market to invest in a mutual fund. If you are new to investing, a mutual fund can be a good place to start because it offers a diversified portfolio and professional management.

But when you have to invest in mutual funds, there are numerous doubts and dozens of questions like, where to start, how much money it requires, what are the best apps for mutual funds, and so on.

Luckily we got you covered. This is the complete list of the best mutual funds apps to begin investing that will clear all those doubts and potential queries you might have.

Also read: 15 Best Trading Apps & Websites in India

20 Best Mutual Funds Apps

There are several different apps available that allow users to invest in mutual funds. Some of these apps are designed for specific investment companies while others are more general.

All the apps for mutual funds mentioned in the list are not exactly in the order of best to worse. The best app for mutual funds will depend on the individual investor’s needs and preferences.

So without further ado, let’s dive in and find out the best ones. Stay tuned!

Also read: List of Best Nationalised Banks of India

1. Coin by Zerodha

One of the greatest apps for investing in direct mutual funds is Zerodha Coin. Over 3,000 commission-free direct mutual funds from 34 fund houses are available through their investment services.

When compared to traditional mutual funds, Coin can help with savings of up to 1–1.5% more annually. The app has already established a significant brand and clientele with over 1,50,000 investors who have spent over 2500 crores and together saved over 30 crores in commissions.

They have a UPI-based purchasing option also you can invest in mutual funds directly from the Zerodha account. They help you with P&L charts, a single capital gain statement, and absolute and annualized returns.

2. ET Money: Invest like a Genius

This Mutual Fund app, which is connected to a well-known Economic Times brand, is another one of the best mutual funds apps and a one-stop shop for everything related to investing and can be used to track and control spending using an expense manager.

Save tax using SIPs in ELSS mutual funds, invest in mutual funds through lump sum or SIP, etc. All types of investors find the app’s informative posts to be of great value. You also have access to a variety of financial services, including the ability to purchase term insurance, life insurance, several forms of loans, and mutual funds.

Related: 30 Best Instant Loan Apps in India

Additionally, this top mutual fund app in India is built on fully automated functionality, which simplifies the process of investing in mutual funds. It provides individualized investment roadmaps that are persistently designed taking into account your unique financial objectives and obligations.

3. Groww: Stocks & Mutual Fund

Groww is arguably one of the best mutual funds apps in India. With little to no paperwork and no hassles, this app makes it easy to invest in mutual funds for free. A single investment app contains all information on mutual funds.

Groww allows anybody to learn how to invest in mutual funds by spending a meager amount of 500 rupees. There are no hidden costs, transaction charges, or fees for the same. You can also switch between direct and regular funds without paying any fee.

Related: List of 21 Best Private Banks of India

It has a simple interface, ideal for both novices and professionals. Along with an investing dashboard that displays annualized returns and total returns. It also features mutual funds list for many categories with the most recent financial information.

4. INDmoney: US Stocks, MFs & FDs

When discussing the best mutual funds apps, INDmoney is another great choice. It is an application to track, save, plan, and invest money. It helps you to spend your money with only one click. All investments, loans, expenses, credit cards, savings accounts, PFs, and EPFs are automatically and securely tracked by INDmoney.

It suggests what steps you can take to increase your portfolio, invest at ZERO commission, and save money. Benefit from free account opening, free KYC, free risk assessment, and the addition of family accounts.

Also read: 30 Best Refer and Earn Apps in India

Invest in Mutual Funds under the Direct Plan in the categories of Index Funds, Large Cap, Mid Cap, Multi Cap, Arbitrage Funds, Debt Funds, and Tax Saving Funds using a lump sum, Systematic Investment Plan (SIP), Systematic Transfer Plan (STP), and Systematic Withdrawal Plan (SWP). Direct investment in US stocks is possible from India, commission-free. Free Direct plan Bonds, SIPs, Fixed Deposits, Mutual Funds, and PMS also.

5. MyCAMS Mutual Fund App

A single gateway to investing in several Mutual Funds schemes is myCAMS. The app enables quicker, simpler, and more intelligent ways to transact with direct money.

MyCAMS provides many features, including mobile PIN and Pattern login, one view of your mutual fund portfolio, the ability to open new folios, make purchases, redeem investments, swap investments, set up SIPs, and more. They provide quick assistance with loans and insurance plans.

One of the best apps for mutual funds, it also aids in the scheduling of transactions, enabling investors to plan out future Mutual Fund transactions. There are no hidden fees or brokerages. It also helps with SIPs and the lump-sum investment options to invest in mutual funds.

6. KFinKart Investor Mutual Funds

This app’s main goal is to make the customer’s experience with mutual funds simpler with extremely user-friendly navigation technology. It is a one-touch mutual fund app and software that gives you the ability to invest in a variety of mutual funds and offers a unique way to do so.

The emphasis is also placed on having a single view of your investments, managing your profile, making decisions, and transacting instantaneously without the need for numerous apps provided by various fund institutions.

By linking and managing your family folios across AMCs, investing in NFOs, transacting or reinvesting, starting or stopping SIPs, and other unique features, this software helps you make the most of your time and money.

7. Angel One

With a free Demat Account, the Angel One app enables you to invest, trade, and expand in the stock market. Your whole financial and investing needs are met. Participate in intraday trading, IPO, F&O, and stock investing.

On a single page, you may access investment opportunities, portfolio statuses, advising, markets, learning, and a market with a variety of well-diversified portfolio suggestions. Easy access to share market analysis studies as well as real-time stock updates.

With the new reporting system, you may quickly check reports like profit & loss and trades & charges of your trades. You can enjoy 0% brokerage on stock purchases and a flat brokerage of Rs 20 per order for intraday, F&O, currencies, and commodities. Also, by using net banking, adding money is simple, making it one of the best Mutual Funds Apps in India.

8. Nippon India Mutual Fund

To provide a best-in-class, enhanced digital experience, this mutual fund app is created with cutting-edge, streamlined new-age features and services. Modern design, speedy product discovery, assisted decision-making, and personalization based on intelligent analytics are all priorities when it comes to excellent e-commerce practices.

Discover the brand-new “Simply Save,” which enables you to invest your surplus money and generate reasonable profits with just the press of a button!

The software is user-friendly. The user interface is far too simple and effective. Because it uses fingerprint authentication, the software is secure. It shows the transaction history even the top-trending funds are displayed. It is advised for those just starting with MF investments.

9. Axis Mutual Fund: SIP, ELSS MF

With the Axis Mutual Fund App, investments may be made quickly, easily, and without paper. You can now invest in SIP/Lumpsum or Switch using only a PAN number (Paperless Transaction).

New investors, first-time investors (KYC validated), and current investors of Axis Mutual Fund can make investments wherever they are and whenever they want to use the app. You can use it to buy, redeem, switch, and begin a systematic investment plan in Axis Mutual Funds Schemes. Additionally, it offers the most recent content, NAV history, and NAV.

It provides a platform for investing in a variety of mutual fund categories, including debt funds, liquid funds, small-cap funds, hybrid funds, mid & large cap funds, and other special situation funds. Additionally, it permits simple investment in NFOs provided by Axis Mutual Fund.

10. SBI Mutual Fund – InvesTap

You can schedule your transactions to receive notifications at a later time to execute the transaction, as well as receive real-time alerts and notifications to keep track of fund NAVs. It monitors both the success of your current investments and your upcoming ones.

With the help of the Family Solution Tool, you can choose the best investment plans, assess your risk tolerance, and make the appropriate investments to meet your financial objective. Under a single User ID, you can access all family members’ statements and view investment information.

Real-time order fulfillment and processing allow you to keep track of your payment and stay informed. The app allows you to compare up to 3 funds and establish a watchlist of funds. These characteristics enable you to make wise investment choices, maximize profits, and fulfill your financial goals.

11. Moneyfy by Tata Capital

Moneyfy is arguably one of the Best Mutual Funds Apps that offer goal-based investment alternatives, allowing you to set objectives and reach them by making lump-sum or SIP investments. The app makes it simple to track monthly SIP investments in real-time, and the SIP calculator can be used to predict your SIP’s return.

Moneyfy makes budgeting and goal-setting simple and convenient. The App’s sophisticated algorithm creates financial plans that are appropriate for each customer’s investment style based on the parameters and goals they have set for themselves.

Customers can build up their own goals and select appropriate investment options using the app. They can invest in a wide range of carefully considered plans through mutual funds, which can be tailored to the various financial goals of each individual.

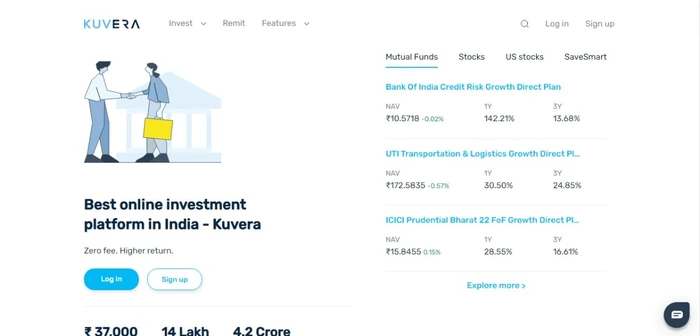

12. Kuvera: MFs, FDs, Stocks

The most noticeable aspect of the Kuvera app is a goal-based investment. Whether you want to reduce your tax burden, increase your wealth, achieve stability, or do anything else, the app offers similar advice. It has 0% in commission or additional fees.

The dashboard enables users to follow their investments and as the investments advance, they can monitor the progress curve. The application also includes incentives for investors.

This program can be used to invest in equities and gold in addition to mutual funds. Its amazing features include timely reports, tax harvesting, and TradeSmart, creating an account entirely online and a provision of family accounts for managing joint accounts, making it one of the best apps for mutual funds.

13. DSP Mutual Fund App

Easily monitor and manage your portfolio with DSP, you can create a customized dashboard that monitors all of your investments. View your investment allocation by, among other things, asset type, cost of investment returns, and profit booked.

Establish a “Family Account” view with which you can easily examine and follow the portfolios, transactions, and systematic plans of your family members. Start and manage your SIPs or invest in a lump sum in a hurry. You can quickly change or halt your SIPs and can begin an SWP or STP as well.

Research and invest in many equity programs. Invest in portfolios that allow you to do so in emerging or small Indian businesses, major or market-leading businesses, some of the most well-known international brands, and particular industries both in India and abroad.

14. Scripbox: Mutual Funds & SIP

With Scripbox you can learn important details about your mutual fund portfolio, such as your asset allocation and fund quality. Receive suggestions that can improve the performance of your portfolio and help you increase your wealth. When you use the Scripbox app you will realize that the funds they choose are the greatest funds that meet your needs.

What makes it one of the Best Mutual Funds Apps, is its simple app interface. Furthermore, it provides exceptional customer service. There are numerous ways to contact you for your concerns, including the phone, Whatsapp, and other platforms, which aren’t usually seen on other apps.

Upload your NSDL CAS to keep tabs on your stock holdings. Both your FDs and real estate holdings should be added and tracked you can also invest directly in US stocks with Stockal.

15. MF Utilities – Mutual Fund App, SIP Investment

A mutual fund industry project called MF Utility seeks to streamline and simplify mutual fund transactions in India for the good of all parties involved. The GoMF mobile app is a step toward enabling the opportunity to transact while on the go, at any time, and anywhere.

It helps you to start a buy-sell-trade, redemption, switch, systematic investment, transfer, or withdrawal process. View and follow each order placed with MF Utility.

Multiple transaction types are supported, including purchase, redemption, SIP, STP, and SWP. It offers connections to different payment gateways and enables users to post questions, feedback, and complaints to provide quick resolution.

16. AssetPlus – Mutual Funds & SIP

Assetplus is among one of the best mutual funds apps which is currently handling the investments of more than 50,000 users who are investing close to 500 crores. Even then, the use of AssetPlus is free of charge. For the services rendered, they bill the mutual fund firms a small fee.

You may invest in mutual funds, initiate SIPs, and keep tabs on their performance on the app. You can start SIPs and invest in mutual funds using their comprehensive online approach in less than 10 minutes.

It may be used as both a tracking app and a SIP mutual fund app since, in addition to offering online mutual funds and SIPs, they also offer a portfolio tracker feature that allows you to keep track of all your mutual fund investments in one place.

17. CashRich Mutual Fund App India

Among the only few best mutual funds apps in India that offer a Dynamic SIP option for higher returns than standard SIPs is CashRich.One-tap chat accessibility, goal-based investment options, and lifetime no-fee investment accounts are just a few of the features.

The app has everything to offer an investor, including a fund calculator that aids in the computation of the funds. You may choose from the top mutual fund schemes and quickly evaluate the past performance of the schemes.

Additionally, they offer the possibility for an immediate withdrawal of cash and recommend investments depending on the investor’s profile. The application includes high-performing programs that fall into categories including long-term, short-term, tax-saving, etc.

18. Niyo Money – Direct Mutual Funds App

All your mutual fund’s needs, questions, and options are taken care of for you by, Neomoney a fully managed goal-based investing advisory platform. It lets you invest in mutual funds without having to be an expert.

The app gives you the best fund suggestions based on our tested data-driven Mutual Fund selection technique and on your goals because they conduct all the research for you. Once you begin investing, if any adjustments need to be made to any of your investments, you get to know about it and you can get back on track in a few clicks.

It is extremely customizable – everything, including goal-setting, fund selection, asset allocation, and risk profile, even SIPs with a flexible start/stop/skip may be tailored to each investor’s needs.

19. Piggy – Transact in Mutual Funds

The goal of this well-developed app is to make investing and money accumulation easier and faster. It provides account opening and other processes that use zero paper. There is no commission and no additional fees.

With just Rs. 100, you may begin a SIP and watch it grow right away. You can earn almost 1.5% more annually and, after 25 years, experience a 45% difference. The client can also invest with ease in digital gold and direct mutual funds.

20. Karvy Nivesh – Mutual Fund, SIP, Investment App

The Karvy Nivesh App has all the features you need to invest in mutual funds. This software is made to help clients strategize and manage their investment needs to reach their financial objectives.

The app is uncomplicated, practical, and simple to use. You can choose from more than 3000 different mutual funds offered by more than 35 different fund houses.

They follow an investment approach based on your goals. The software is incredibly informative and user-friendly thanks to its well-designed user interface. It needs only a one-time KYC.

The portfolio of your fund is simple for you to follow. You can also set up auto-debit for the SIP installments by connecting the app to your bank account. The investment options include SIP and lump sum.

FAQs

Which app is better for mutual funds?

The best app for Mutual Funds in India is Coin by Zerodha, Groww, ET Money, Paytm Money, MyCAMS, KFinKart, and more.

Which app is best for mutual fund analysis?

There is no definitive answer to this question, as different investors have different preferences and needs when it comes to analyzing mutual funds. However, some popular apps for mutual fund analysis include Money Control, ET Money, Groww, Zerodha’s Coin, and many more.

Is it safe to invest through mutual fund apps?

Yes, it’s safe to invest through mutual fund apps since the money you invest through these apps is directly regulated and monitored by the Securities and Exchange Board of India (SEBI), which strives to protect the interests of investors.

Wrapping up on Best Apps for Mutual Funds

These are some of the best apps for mutual funds in India. These apps will help you to plan your investments and also keep track of your investments.

The best mutual fund apps provide investors with the ability to research, track, and manage their investments from the convenience of their mobile devices. These apps offer a variety of features that can help investors make the most informed decisions about where to invest their money. In addition, many of these apps offer the ability to set up automatic investments, which can help investors stay disciplined and on track with their investment goals.

The best apps for mutual funds in India are those that offer a wide range of investment options, allow you to track your portfolio, and provide helpful resources and support. When choosing an app, be sure to consider your investment goals and risk tolerance. The best app for you may not be the same as the best app for someone else.